Returns & Reverse Logistics: Best Practices When Fulfilled From China

Getting more orders is great.

Getting more returns? That’s where margins disappear.

If you’re fulfilling from China,

returns and reverse logistics are not just an ops issue —

they’re a strategy issue.

I’ll break down how reverse logistics from China really works,

what best practices actually matter,

and how brands handle returns without killing profit.

No theory. Just what works.

Why Returns Are Harder When Fulfilled From China

Let’s be honest.

Domestic returns are annoying.

Cross-border returns are expensive and complex.

When orders ship from China, you’re dealing with:

International shipping costs/Customs re-entry issues/Long transit times/Inventory recovery decisions

This is why reverse logistics China needs planning upfront —

not after returns start piling up.

What “Reverse Logistics” Means (Simple Definition)

No buzzwords.

Reverse logistics =

what happens after a customer sends a product back.

That includes:

Return routing/Inspection/Restocking or disposal/Refund coordination/Data tracking

If this isn’t designed early, returns turn into losses.

Common Return Scenarios for China Fulfillment

From what we see, most returns fall into 4 buckets:

Damaged in transit/Wrong item shipped/Customer remorse/Product expectation mismatch

Each requires a different reverse logistics strategy.

Treating all returns the same is a mistake.

Best Practice #1: Don’t Send Everything Back to China

This is the #1 mistake.

Shipping every return back to China usually means:

High shipping cost/Customs delays/Inventory value loss

Instead, smart brands use localized return solutions.

What that looks like:

Local return addresses (US / EU)/Consolidated return handling/Selective re-shipment to China

This alone can cut return costs by 30–50%.

Best Practice #2: Decide “Return vs Refund” Early

Not every product should come back.

For low-value items, it’s often smarter to:

Refund without return/Let customers keep the product

A good reverse logistics China setup includes rules like:

Auto-refund thresholds/Product category decisions/Cost-based logic

Returns should be a financial decision, not emotional.

Best Practice #3: Inspection & Grading Matter

Returned products are not equal.

You need a simple grading system:

Grade A: resale-ready/Grade B: repackage or bundle/Grade C: dispose or donate

This inspection can happen:

At local return centers/Or at China fulfillment warehouses (for bulk returns)

Without grading, inventory data becomes fiction.

Best Practice #4: Sync Returns With Inventory Systems

Here’s where things break.

If returns aren’t synced:

Inventory shows false stock/Overselling happens/Refunds get delayed

Your fulfillment partner should support:

Return status tracking/Inventory adjustment automation/Refund triggers

A Quick Story (Real Example)

One seller told me:

“Returns are killing us, but volume is good.”

We looked closer.

Problem?

All returns shipped back to China/No grading/No local processing

Fix?

Added local return center/Implemented refund-without-return rules/Only bulk-shipped resale inventory back to China

Result?

Return costs dropped 40%/Refund time cut in half/Customer complaints went down

Reverse logistics isn’t sexy — but it’s powerful.

Best Practice #5: Packaging Impacts Returns More Than You Think

A lot of returns start before delivery.

Weak packaging leads to:

Transit damage/Customer frustration/Refund requests

For China fulfillment, packaging should focus on:

Transit protection/Clear labeling/Easy re-pack (for returns)

Dropshipping vs Bulk Fulfillment: Returns Difference

This matters.

Dropshipping Returns

Lower inventory recovery value/Often refund-first strategy/Minimal re-shipment

Bulk Fulfillment Returns

Higher recovery potential/Grading + restocking/Better long-term margin control

Your reverse logistics plan should match your fulfillment model.

Common Reverse Logistics Mistakes

Quick warning list:

❌ Treating all returns equally

❌ Shipping everything back to China

❌ No cost logic for refunds

❌ Manual return tracking

❌ Ignoring packaging quality

Returns expose weak operations fast.

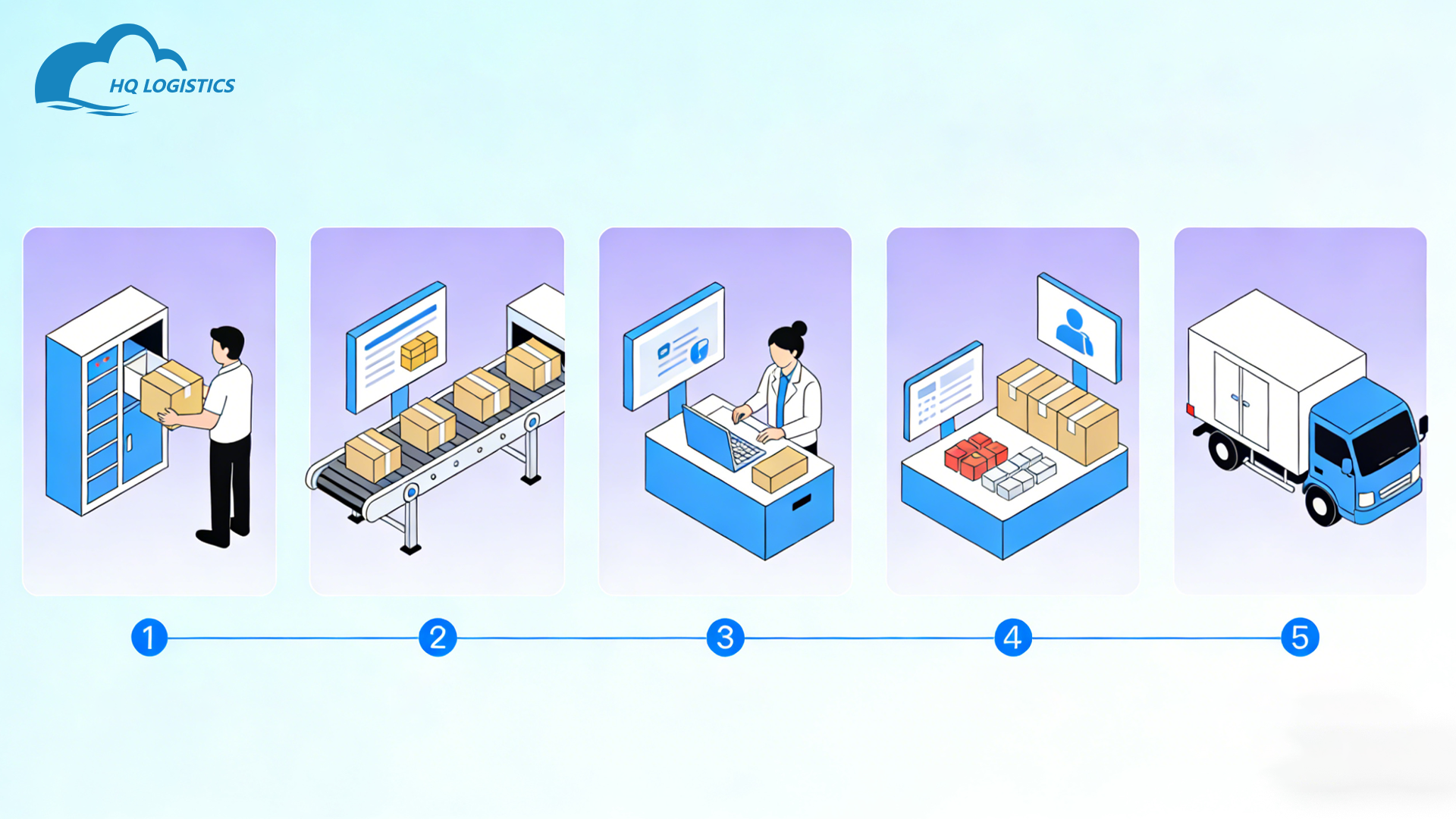

How HQ CLOUD Handles Reverse Logistics From China

At HQ CLOUD, we don’t treat returns as an afterthought.

Our reverse logistics China approach includes:

Local return address options/Consolidated return handling/Inspection & grading workflows/Inventory resync automation/Smart refund rules/Optional re-shipment to China

This helps brands control costs without hurting CX.

FAQs From Real Sellers

Should I always take returns back to China?

No. Often it’s not cost-effective.

Are local return centers worth it?

For volume sellers — absolutely.

Can returns be resold?

Yes, with inspection and grading.

What’s the biggest cost driver in returns?

International shipping and poor packaging.

Final Thought

Returns are part of growth.

But unmanaged returns kill profit.

If you’re fulfilling from China,

you need a reverse logistics China strategy that’s intentional, data-driven, and flexible.

That’s how smart brands protect margins —

even when returns increase.

📩Email: zoye@fulfllment-cn.com

PREVIOUS RECOMMENDATIONS

Customer's favorable comments is our eternal motivation. We feel grateful for all the support and company.

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua.